https://blog.seneca.it/wp-content/uploads/2020/10/linea2_ok.jpg

https://blog.seneca.it/wp-content/uploads/2020/10/linea2_ok.jpg

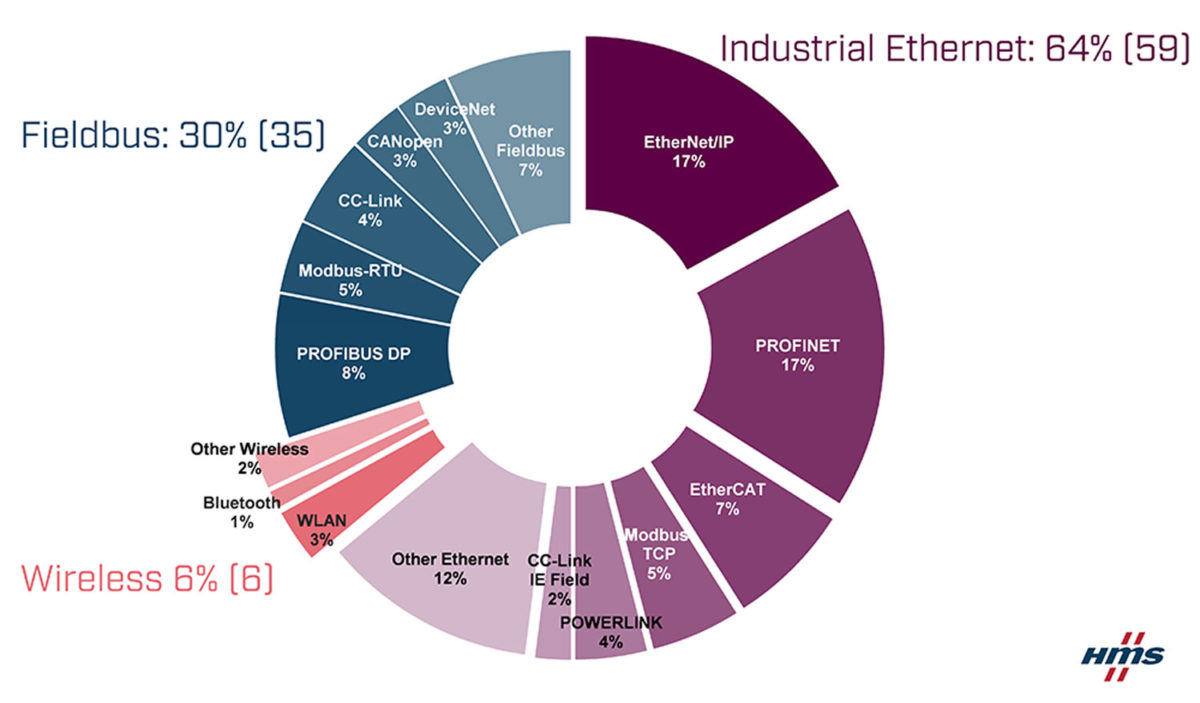

The usual market analysis on industrial networks presented by Hms Networks examined the estimated market shares for Fieldbus, Industrial Ethernet and Wireless technologies. Due to the Covid-19 pandemic, growth rates have not been estimated this year, but clear trends have emerged to be taken into account.

Growth of Industrial Ethernet

Also in 2020, the growth of the various Industrial Ethernet is accentuated, which continue to take market share away from fieldbuses. Industrial Ethernet networks now represent 64% of the global market for new nodes installed in factory automation (compared to 59% last year). EtherNet/IP and Profinet share first place with 17% of the market. EtherCAT continues to cover 7% of the global market, but the real surprise is the confirmation of ModBUS TCP-IP.

The ModBUS TCP-IP case

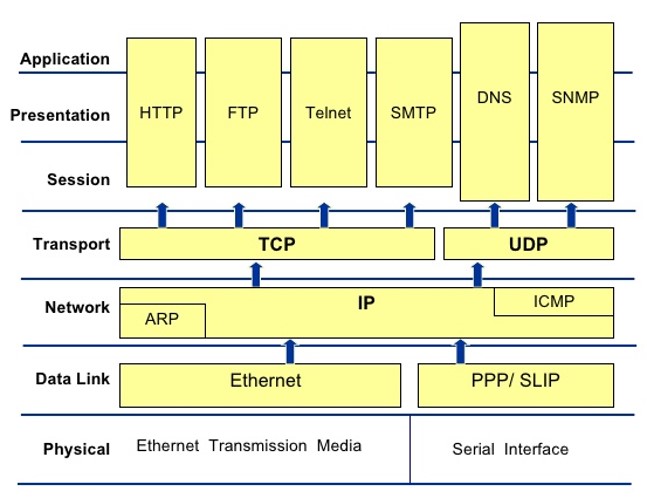

The MODBUS protocol is a widely recognized standard and, in its serial version, has one of the largest installed parks in the world. In particular the versioen ModBUS TCP-IP holds 5% of the market share and even surpasses Ethernet Powerlink by 4%. The interesting aspect of this protocol widely adopted in SENECA products is to make ModBUS particularly performing in automation architectures for the dialogue between intelligent devices because, thanks to Ethernet, it makes communication faster and safer. Modbus TCP-IP is in fact able to manage the master side of the communication both of RTU and TCP-IP protocol, through a single driver.

It also offers the possibility to manage directly on Ethernet the ModBUS peripherals and since the protocol is transmitted over IP, it is possible to connect also with geographically distributed peripherals. Finally, ModBUS TCP-IP is a protocol substantially royalty-free and supported by runtime licenses freely usable.

Fieldbus drop

The drop in fieldbuses is estimated at around 30% of new nodes installed (compared to 35% last year). Profibus is still in first place (8%), but for the first time it represents less than 10% of the total industrial networks market. However, it is interesting to note that ModBUS registers a good trend, whether it is ModBUS RTU or Ethernet based on TCP-IP showing how automation continues to prefer well functioning and consolidated technologies in production plants, even if they have been used for a long time.

Stable wireless with growth prospects

Finally the wireless. Wireless technologies represent 6% of the total market, with WLAN technology proving to be the most widespread, followed by Bluetooth. Wireless therefore maintains its position in a market in strong and continuous growth. With all the ongoing activities worldwide related to LTE/5G/IoT technologies as enablers for intelligent production in factories, the demand for devices and machines connected wirelessly is expected to grow more and more. The integration of wireless technologies into machines and automation architectures, with flexibility and interconnectivity, is an inevitable trend.